Should you leave inheritance to your children?

Hi FQ Mom, I’ve been following you for years. I just want to hear your thoughts on leaving an inheritance to your children. What do you think is necessary, and what do you think is too much? Will buying houses for them and their future families hurt their long-term progress? I’ll be very grateful if you respond. Thank you in advance and more power to you. – Des via FB

Hi Des. Your question is very interesting and there are many schools of thought with regard to this.

The oracle of Omaha who’s considered as the world’s greatest investor, Warren Buffett, famously said this about inheritance, “Leave your children enough so they can do anything, but not enough so they can do nothing.”

In 2010, the Giving Pledge campaign was launched by Bill Gates and Warren Buffett to encourage wealthy people to contribute a majority of their wealth to philanthropic causes. This is because they realize that giving huge sums of money to their children is a disfavor as it distorts anything that they might do and could actually be a hindrance to the creation of their own paths. Instead, the majority of the wealth of these very rich people all over the world will be used to solve the world’s pressing problems. For instance, the Gates Foundation has a mission of wiping out poverty, disease, and hunger.

You may now ask, “But I don’t have billions of dollars as the 236 signatories to the Giving Pledge have, will the same rules apply? Will I distort my children’s lives by giving them inheritance?”

There are various matters to think about in order to answer this.

1. Did you inherit anything from your parents?

It will be good to look at your own situation. If you were given an inheritance, what did this do to you? Did it help you start something? Was it cash or a house that you lived in when you started your family? How was the distribution among you and your siblings, or other beneficiaries? Was it peaceful or contentious?

If you were not given any inheritance, what did it do to you? Did it make you more motivated? Was it a big factor in what you have achieved now?

Thinking about all the actual effects of the presence (or absence) of inheritance on you will help you figure out how you want to pass on your wealth to your children. We learn a lot from our own experiences.

2. How much income are you making right now?

Are you able to provide well for your children’s needs such as healthy home, good education, and some affordable pleasures that will help them create loving childhood memories with the family? On top of these, are you able to set aside for your own retirement that includes the standard of living that you want in your old age with sufficient health care and leisure activities, and maybe some philanthropy? If all of these are covered, then you can probably start setting aside for your children’s inheritance.

3. What head start do you want to give your children?

Inheritance is a gift. It should be given voluntarily with the hope that it is something that will be useful to and appreciated by the receiver. The house that you asked in your message will give them a head start when they raise their own family. A fund that you set aside for them may help jump start a business that your entrepreneurial children can use. Or it can also help fund further studies for a child who wants to pursue one.

4. When should you to tell them about their inheritance?

Here’s my personal take on this. Unless I am giving it now, I would prefer not to earmark assets to any of our children yet. Doing so already gives them an entitlement, almost like an ownership of the property. What if you will need to sell it for whatever reason? The child will feel bad that you’re disposing of “his” property and might feel cheated.

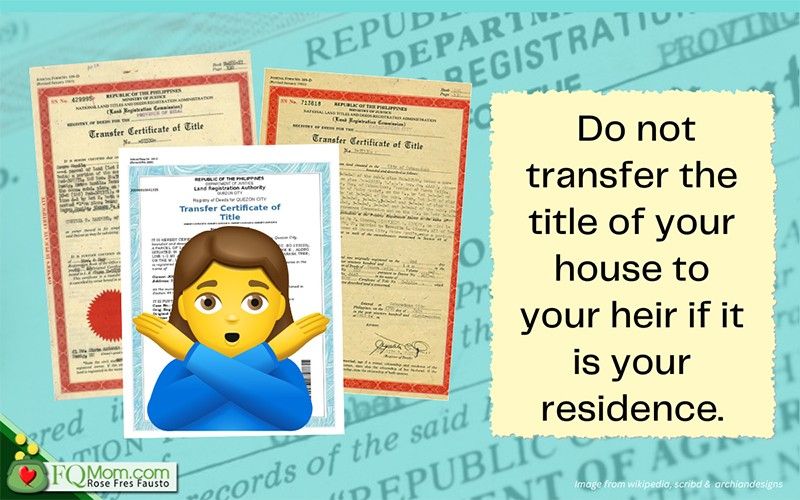

5. Never transfer the title of your place of residence.

We’ve heard of horror stories where parents already transfer the title of their residential property where they live in order to cut on taxes. This is a big no no. Anything can happen and it is not wise expose yourself to the possibility of being homeless.

6. Consider the possibility that you might outlive your retirement fund.

It is very difficult to predict how much we really need for our retirement. Life expectancy has increased. The cost of living and healthcare is also difficult to predict as we do not know what we will be sick of when we get old. This is in line with the previous item number 4. If you outlive your retirement fund, it will be good to have the flexibility to sell any of the properties that you have, instead of asking money from your children or anyone else.

But here’s the thing. If you handle your finances well, you will likely leave inheritance to your children. It doesn’t have to be substantial, and hopefully, it will not be something that they are counting on, especially if they are already grown up and well equipped to earn their own living. If this is the case, anything that they will inherit from you will be a gift.

7. Trust and will

Consider having a trust to provide legal protection of your assets and ensure they are distributed according to your wishes. Write your will and that’s where you detail what property you want to leave to each of your children.

8. Talk to your children about money healthily

I cannot overemphasize the importance of raising your children to have high FQ. Talk about money in an open and healthy way. Since you’ve been following me for years, I’m sure you’ve read my articles and books on how to do this. Have them take the FQ Test and track their scores as they go about improving their money behavior as they get older. If they have a high FQ, you will be more comfortable with their future, whether you are able to leave inheritance to them or not. They will be fine and they will know the true purpose of money in their lives – that is to fulfill their core values!

There are other important topics that are relevant to this matter such as legitim, giving with a warm hand than a cold one. We will also discuss these in future articles/podcasts. For the meantime, I hope the above eight items will help you figure out what’s best for your own family’s situation.

Cheers to high FQ!

Announcements

1. The best way to prepare our children for a smooth transfer of properties and for them to be financially independent regardless of inheritance is to raise them with high FQ. Start their journey now, take the FQ test with them. Click here.

2. You can also include in their reading repertoire FQ books. Visit our bookstore by clicking FQ Mom Books.

This article is also published in FQMom.com.

Attribution: Image from Latest Laws and Freepik

- Latest